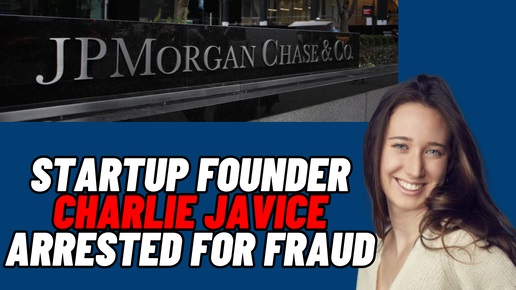

The $175 Million Charlie Javice fraud case, which came to light with the acquisition of the fintech startup Frank by JPMorgan Chase, has highlighted several critical operational failures within one of the largest financial institutions in the world. Javice, the founder of Frank, was accused of fabricating user data to inflate the company’s value before its sale to JPMorgan for $175 million. This incident underscores the importance of due diligence, risk management, and internal controls in corporate acquisitions. Here, we will examine the key operational failures that contributed to this debacle.

Due Diligence

One of the most glaring failures in this case was JPMorgan’s due diligence process. Due diligence is a fundamental step in any acquisition, meant to uncover potential risks, verify claims, and assess the true value of the target company. JPMorgan’s inability to detect the falsified user data indicates significant gaps in their vetting procedures. Effective due diligence should involve thorough verification of data through independent audits or direct customer feedback, comprehensive background checks on key executives and founders, and detailed technical audits to ensure the robustness and authenticity of the technology and platforms being acquired.

Data Source

JPMorgan appears to have relied heavily on the data provided by Frank, without sufficient independent validation. In the fintech sector, where user engagement and growth metrics are crucial indicators of a company’s health, self-reported data can be easily manipulated. To mitigate this risk, acquiring companies should implement cross-verification mechanisms using multiple sources to confirm key data points, adopt conservative valuation models to account for potential discrepancies, and apply rigorous assumptions in valuation models.

Internal Controls

Effective risk management is essential in preventing fraud and ensuring the integrity of financial transactions. JPMorgan’s internal controls failed to identify and mitigate the risks associated with the Frank acquisition. Enhancements in risk management practices could include developing more rigorous risk assessment protocols, strengthening internal audit functions to conduct independent reviews, and implementing continuous monitoring systems to detect unusual patterns or discrepancies in real-time.

Project Risk Management

Post-acquisition integration is a critical phase where the acquiring company assimilates the new entity into its operations. In the case of Frank, better oversight during this phase could have revealed inconsistencies sooner. Effective post-acquisition practices should involve detailed integration plans that outline specific milestones and performance metrics, regular progress reviews involving cross-functional teams, and engagement with key stakeholders, including customers, employees, and partners, to gather feedback and ensure a smooth transition.

Risk Culture Gaps

The Frank acquisition also highlighted potential cultural and leadership gaps within JPMorgan. A strong organizational culture and effective leadership are crucial in fostering an environment of integrity and accountability. JPMorgan could benefit from investing in leadership development programs that emphasize ethical decision-making and transparency, ensuring cultural alignment between the acquiring and acquired companies, and establishing and communicating clear ethical guidelines and expectations for all employees.

The Charlie Javice fraud case serves as a stark reminder of the vulnerabilities that can exist within even the most sophisticated financial institutions. For JPMorgan, this incident underscores the need for more robust due diligence processes, enhanced risk management practices, and a stronger emphasis on ethical leadership. By addressing these operational failures, JPMorgan and other financial institutions can better safeguard against similar frauds in the future and restore trust in their acquisition practices.