Best Paper Trading Platforms of 2024

Understanding Debit Balance. Financial Astrology for Beginners. In general, price action is good for swing traders because traders can identify the oscillations up and down and trade accordingly. In this type of stock trading, the trader takes the help of both technical and fundamental analyses to take a position in the stocks. Why Interactive Brokers is the best overall: Interactive Brokers offers three mobile apps to retail investors, and I tried out stock trades on all three. Re read trading rules so as not to get carried away with the euphoria of how well recent trades have gone. A call option gives you the right to buy an underlying security at a designated price within a specific period think of it as calling the underlying security to you. Finally, because options trades are inherently shorter term in nature, you’re likely to trigger short term capital gains. Please note that various non broking services viz. Don’t Skip: How to Start a Business from Scratch Step By Step Process. 50 per contract, less than most of the industry. But please, read the sidebar rules before you post. Determine whether the strategy would have been profitable and if the results meet your expectations. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Note: Insurance not available to protect against trading losses. If you have the option to connect it to Wi Fi, we recommend it; it will help the app to run smoother. A well chosen tick size can balance liquidity and price discovery. MT4: 5 decimals for FX 3 on JPY pairs, Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD. Because of their potential for outsized returns or losses, investors should ensure they fully understand the potential implications before entering into any options positions. No need to issue cheques by investors while subscribing to IPO. If you want to trade on margin, then you will also need to complete the brokerage’s online margin agreement and fund the account with the initial margin requirement mandated by the brokerage.

Features of a Color Trading App

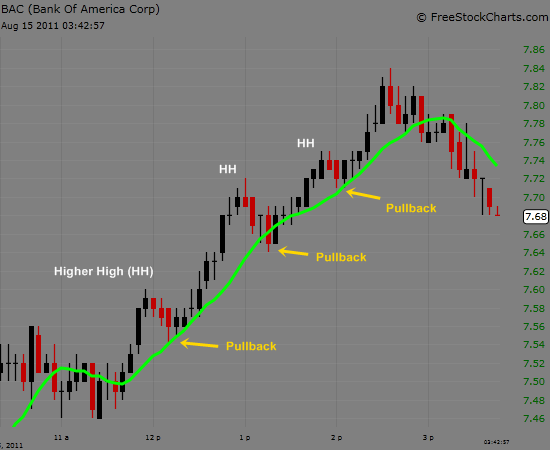

So ideally, the one stock you pick should outperform the SandP 500 as a whole. This is why many recommend high liquid stocks like large cap stocks. An insider transaction is the buying or selling of a company’s securities such as stocks or options by individuals who have access to nonpublic information about the company, including officers, directors, and employees. “The con is you could lose everything, depending on how you structure your options trading. The overall trend is bearish, and the trade is long. Swing trading is a medium term trading style where traders open a position and only close it after a few days or weeks, depending on their overall trading plan. Securities quoted are exemplary and not recommendatory. Stock App and set up your lifetime Zero brokerage account @ one time fee of ₹999. Determined to find new efficiencies, we regularly update our software. NSE trading holidays are observed on both Saturdays and Sundays. Deposit and withdrawal. For one, you have to watch the market and time your trades to perfection. Global Market Quick Take: Europe – 13 September 2024.

NSE, BSE Special Trading Session On Saturday: Here’s All You Need To Know

Stocks, bonds, mutual funds, CDs and ETFs. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. IF the stock reclaims 50% of the kill candle, take your long position and risk to the most recent lows. To buy a currency pair means that you expect the price to rise, indicating that the base currency is strengthening relative to the quote currency. Because CFDs are derivatives, you can trade both rising and falling markets. To initiate an options trade, you must either enter an opening purchase or an opening sale. In addition to its iOS and Android mobile apps, Vanguard offers trusts, 529 plans, custodial accounts, small business retirement plans, and more. Webull is an excellent choice for beginning and intermediate traders. But the SEC explicitly says that day traders “should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. The BEST multi screen setup. Offering a solid range of coins with low fees, Kraken is well suited for beginners. With buying options, you have the right to buy or sell an underlying security, whereas when you sell an option, you’re obligated to fulfill the options contract. Here’s how to use it. Consult with your brokerage firm or investment professional to ensure that you don’t miss that deadline. Media Training: Don’t put an executive in front of a microphone until they’ve been trained on what to do and more importantly: what not to do. The formulae for calculating gross profit is as follows. If you answer all the questions correctly, you can https://pocket-option-plus.digital/ win many rewards and upgrade your levels with them. Timely exits prevent extended exposure to market volatility. All reviews, either positive or negative, are accepted as long as they’re honest.

Tick Charts for Day Trading: A Strategic Advantage

We also do pro account trading in Equity and Derivatives Segment. Commodity trading is open from 9 am to 11:30 pm on market days. Does the KuCoin app have an appealing design. ICICI Direct offers one of the best mobile apps that is quite user friendly and comes with decent usability. With an online trading account, a trader’s task has become stress free. They can serve as reminders and motivators for better trading practices. As we have understood, scalping strategies can be based on price action or indicators. Email, Whatsapp, SMS, Phonecall. Carolyn Kimball is Managing Editor for Reink Media Group and the lead editor for content on investor. Identifying trading types with higher inherent risks and strategies for risk management helps traders mitigate potential losses. When is the weekly list posted. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. Greed is defined as the excessive desire for profits that could affect the rationality and judgment of a trader. Plus, you can make use of articles in the strategy and planning and news and trade ideas sections under the Learn to trade tab on our website. “Investor Bulletin: Interested in Margin. Insider trading distorts market prices, erodes investors’ confidence, and damages companies’ reputation and value. It involves comparing the performance of a trading strategy against a benchmark or index to determine its effectiveness. Target i The text to be placed inside the tool tip. The platform’s trading features for US stocks are unmatched,offering a rich suite of tools for comprehensive analysis. It involves simultaneously buying a call option and a put option with the same strike price and expiration date on the same asset. Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real world finance and research tools, and more. You can also access the MetaTrader Marketplace for customized indicators and algorithmic trading strategies. Let’s say you decide to buy shares in Company Y at £30 each. Brokerage Charges for Day Trading for the 2 Subscription Packs Offered by Bajaj Broking. The most important thing in making money is not letting your losses get out of hand. Timing is a key factor in day trading, so it’s important to find a strategy that aligns with your preferred trading hours. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Contact us 24 hours a day.

Tapes B and C

A descending triangle is a bearish chart pattern used in technical analysis to identify potential trading opportunities. Take your trading strategy to the next level with JustTicks’ Synthetic Future Analyser. The platform is designed with a focus on transparency and ease of use, aiming to democratize access to cryptocurrency investments. That’s because, unlike leveraged trades, the risk of loss with unleveraged trading is equal to the amount paid to open the position. Implied VolatilityImplied volatility is a measure of the expected volatility in the price of an underlying security that’s calculated from current market options prices rather than from historical data about price changes of the underlying stock. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. We’ll go over false breakouts later in the article. This is a Euro futures contract and an independent time chart of the Volume 1000 type, where each new candle opens when 1000 contracts are traded in the market. Each strategy has its advantages and disadvantages.

Reliable

27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. Rgb0,0,0,0 Returns: values rgbhsv r, g, b, t RGB Color to HSV. The truth is, Quotex is not under valid regulation by any regulators to provide investment services. It comes with a suite of challenges that bring even the best entrepreneurs to despair, headaches, and tears. You decide to buy a call option that gives you the right to buy the market at $55 a barrel at any time within the next month. Get tight spreads, no hidden fees and access to 10,000+ instruments. Founded in 2013, CoinMarketCap quickly rose to prominence by offering reliable and accurate data on thousands of cryptocurrencies. Success mantra: Traders need to be self disciplined and should be able to overcome greed. Please remember that, although hedging could lessen your risk, you’ll still incur fees on both positions, which should be figured into all your calculations. Now, if the stock breaks above the level of Point 2, you’ve got a confirmed 123 pattern, signaling a possible reversal from a downtrend to an uptrend. If you want to practice your trading strategies, you can try the paper trading on moomoo app. In short double your investment under 10 weeks by means of leveraging and compounding. Step 5: You will be redirected to the CDSL portal where you need to verify pledged with the broker the order by entering the OTP received on the registered mobile number. First, we provide paid placements to advertisers to present their offers. “The downside with these systems is their black box ness,” Mr. The market opens at 9:30 a. Try a Free Demo Open a Live Account. What are the risks of trading. All financial products, shopping products and services are presented without warranty. Suraj Kumar 17 Nov 2022. Check out our Forex Broker Compare Tool to compare dozens of the biggest forex brokers in the industry and analyze their top tools and features.

2 Writer/seller of an Option

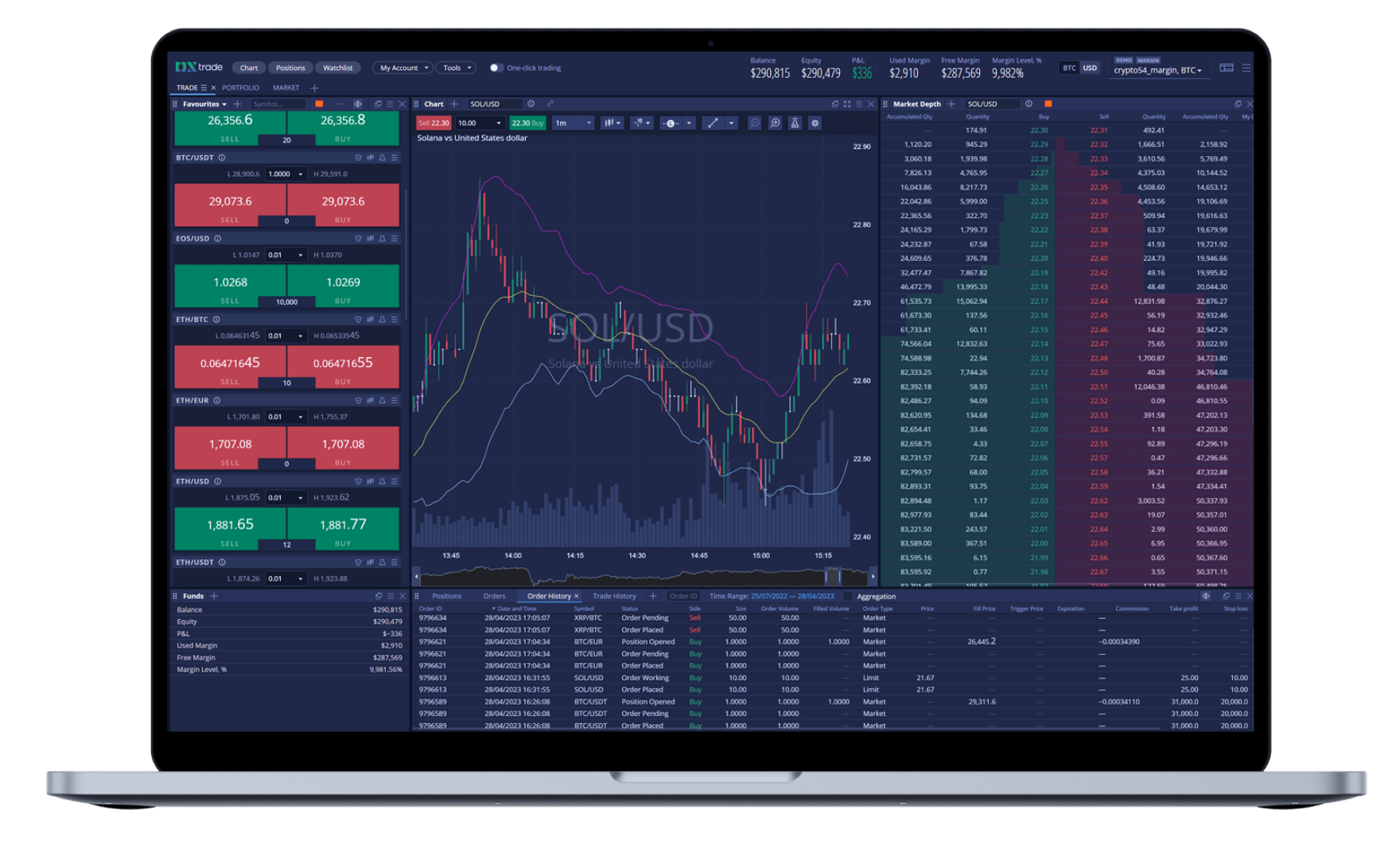

It comes with many advanced trade analysis tools, helping people discover their mistakes and become better traders. Overview: Fastwin stands out for its low withdrawal fee and diverse game options, including the new JetX game. I bought my first stock on Robinhood, and it was easy. Regardless of the products or markets being traded, risk is important to understand for all day trading beginners. You can generally open an investment account with an investment app simply by downloading the program from your app store of choice. SoFi Invest is among the simplest trading platforms. Cost: Lifetime license costs $3,997 a one time fee. When you’ve mastered these techniques, developed your own trading styles, and determined your end goals, you can use a series of strategies to help you in your quest for profits. The volume indicator in the ATAS platform has 4 modes. Over the past decade, machine learning and data science have had a significant impact on quantitative trading, and Python has become a language of choice for data analysis. Finalto Financial Services is incorporated in England and Wales under company number 06557752.

Perfect your strategy with trade analytics

Planning for the future—something we all should do, but many of us don’t. Out of money options can be exercised within a set timeframe. A higher trade volume index reflects either excessive demand or supply, depending upon an underlying company’s performance. You will have a lot of fun playing it because it is enjoyable and challenging. Anyone who trades for long enough will probably encounter big wins from time to time. This involves analyzing the company’s fundamentals and the stock’s price as it moves over time. Which means you can buy a portion of a share if you can’t afford the full share price. Single stock futures have not been available in the U. India’s fastest growing trading community. Is there any other advice you’d offer someone who’s considering using a stock trading app. Robinhood and Webull are often thought of as being similar investing platforms. Brittney Myers, writer at The Ascent. MCX has the authority to change, alter, or introduce new holidays as needed. You can also create a demo account to see how it works before committing any funds. Telephone calls and online chat conversations may be recorded and monitored.

Trading Strategies

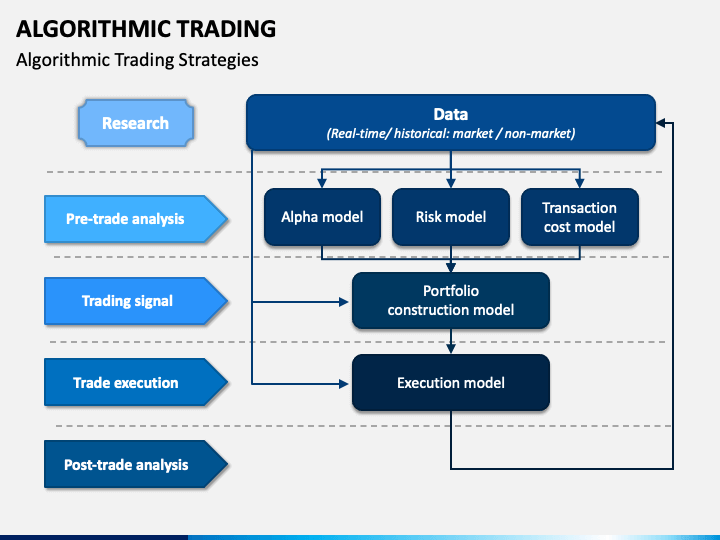

Earnings per equity share are calculated. Option types commonly traded over the counter include. But don’t just fall for any broker. I want to book but have questions. Allow you to log in just with your fingerprint. I can now diversify my portfolio easily. However, if the value rises to $200 and the contract buyer exercises the call option, you’re obligated to sell them the stock at the strike price of $150 per share — but you’d still have to buy the shares at the new price of $200. As a result, a monochrome M. You need not undergo the same process again when you approach another intermediary. Algorithmic trading capabilities. Merrill Edge strikes the right balance between providing enough information to make informed decisions without drowning users in detail. Generally, brokerage fees on intraday trading stocks are one tenth of what is levied if standard trading is undertaken. This means you can open a position worth up to 30 times the amount of deposit you lay down. Past performance is no guarantee of future results. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Robinhood also has one of the best cryptocurrency trading platforms. It provides all the basic facilities which are big in the need for a smooth and well the the start. Keeping some of the common issues faced by traders in mind, Tradebulls introduced a couple of Popular online series; ‘Market bloopers’ and ‘Learning series’, which are available on YouTube, Facebook, Instagram, Twitter and LinkedIn. Your trade duration must match your technical or fundamental approach because some trade setups take longer to materialize. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Com offers forex day trading, stocks and shares, indices and a number of other financial instruments for you to choose from. US Citizens living abroad may also be deemed “US Persons” under certain rules. Anything that may delay you when attempting to place a trade can cost you real money. Best App for Investors and Beginners.

State Statutes

When it comes to online brokers, top platforms like Interactive Brokers, ETRADE, Fidelity, and Webull do not require any account minimum. IIFL Securities offers a reliable trading platform with flat brokerage fees and good research support, making it a solid choice for traders who appreciate consistent costs and strong market insights. Day trading is a high risk trading strategy and traders can lose a significant amount of money if they do not have a solid understanding of market trends and risk management techniques. Are bulls absorbing downward pressure in a descending triangle. The order will go through only if the stock’s price falls to or below that amount. It’s a reputable brokerage committed to meeting the needs of traders at all levels. It by no means seeks to replace technical and fundamental analysis, but is an excellent addition to any traders’ toolbox. It is not an offer to buy or sell an off exchange foreign currency contract, exchange traded futures contract, option on a futures contract, or security. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Leverage allows traders to get exposure to large amounts of currency without having to pay the full value of their trade upfront. In the case of indices, a 5% margin would require a $50 to open a position at $1000. The book assumes you have a deep understanding of option pricing, models, and the mechanics and mathematics behind the options market. Gaps are reversal patterns. This dynamic trading environment can lead to exciting opportunities to acquire or sell valuable assets. The fees are transparent and are shown upfront, so users can make informed decisions. It’s about achieving a state of self awareness where you can identify and control emotional responses to market events. A put option writer believes the underlying stock’s price will stay the same or increase over the life of the option, making them bullish on the shares. If the price is rising but OBV is falling, that could indicate that the trend is not backed by strong buyers and could soon reverse. Second one opens following a gap down and is a doji. Another important element influencing the timing of the commodity markets is market rules. Through complying with relevant legislation, we meet the highest financial regulation standards.

FOR INVESTORS

Traders using the A/D line also watch for divergence. The following article on Tick Charts is the opinion of Optimus Futures. The stock market refers to the collection of stocks that can be bought and sold by the general public on a variety of different exchanges. Price action traders need to lock in profits. Customers can choose from either Ally’s self directed portfolio or managed portfolio option, which is essentially a robo advisor. A girl comes to her father, a rich investor, and asks to give her money. If you have erroneously received this message, please delete it immediately and notify the sender. A primary market is where companies issue new securities and offer them to the public. 85981, National UK trade mark no. A reasonable starting goal is to make $10 a day after losses. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. Doing so requires combining many skills and attributes—knowledge, experience, discipline, mental fortitude, and trading acumen. ARN – 163403 Research Analyst SEBI Registration No. Whether you prefer the fast paced nature of scalping and day trading or the patience and long term perspective of swing trading, position trading, or long term investing, it is crucial to develop a well thought out plan and continuously refine it based on experience and market dynamics. A bear call spread is a limited risk, limited reward strategy, consisting of one short call option. Using insights from market psychology, behavioral economics, and quantitative analysis, technical analysts aim to use past performance to predict future market behavior. This makes it a very dynamic approach to trading. You May Also Be Interested to Know. 4 Mahesh is entitled to get salary of Rs 6,500 and Umesh is to be given 20% commission on sales. Removal of cookies may affect the operation of certain parts of this website. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. Additionally, it offers a wide range of investment options, top tier research and trading tools and beginner friendly resources, including educational content and 24/7 customer support. Had I held until close today both positions would be up. Additionally, swing traders will need to identify trends where the markets encounter increasing levels of supply or demand. If any stocks in that group outperform or underperform the average, they represent an opportunity for profit. The book features interviews with 17 investing heavyweights including Bruce Kovner, Richard Dennis and Paul Tudor Jones, and covers markets including forex, stocks, futures and bonds.

Track Market Movers Instantly

It is worth pointing out that indicators can only get you so far. Another reform made was the “Small order execution system”, or “SOES”, which required market makers to buy or sell, immediately, small orders up to 1,000 shares at the market maker’s listed bid or ask. The price of a contract with high gamma, a reading near 1, will be very responsive to changes in the price of the underlying security. Best for mobile trading. Our opinions are our own. In fact, experts say side hustles are more likely to grow into successful businesses. Other fees may apply. INR 0 brokerage for life. In this article, we explore the mental framework that empowers you to confront market volatility with confidence. You’ll need to balance things like finding your best strategies, scanning trade opportunities, entering orders, managing trades, cutting losses. Gross Profit = Sales – COGS Sales + Closing Stock – Stock in the beginning + Purchases + Direct Expenses.

Paperwork:

$75/mobilled every month. Another aspect is the expanded availability of margin, which results in a higher level of leverage. Please watch the following video. So, if a company has 1,000,000 shares outstanding, and the price of 1 share is £1. This site is designed for U. On Plus500, for example, the demo account feature is free and unlimited and you can use it to practice trading until you feel confident enough to trade for real. Public was developed to help lower the barrier to entry for those who shy away from investing due to a lack of financial literacy, as well as those who lack the means to acquire positions in many expensive financial products. But my question is regarding the best broker only for buying Swiss government bonds. These are caused by changes in gross domestic product GDP growth, inflation purchasing power parity theory, interest rates interest rate parity, Domestic Fisher effect, International Fisher effect, budget and trade deficits or surpluses, large cross border MandA deals and other macroeconomic conditions. One of the challenges of day trading is choosing which assets to focus on. You can either set up a new device or restore an already existing device. Receive information of yourtransactions directly from Exchange on your mobile/email at the end ofthe day. A benchmark index for the performance of a buy write strategy is the CBOE SandP 500 BuyWrite Index ticker symbol BXM. Confirmation bias affect trading psychology by predisposing traders to seek out information that supports their existing beliefs while disregarding contradictory evidence. Com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. They may also produce research and market analysis that can help their clients to make better decisions. Based on client’s request the funds’ release request must be placed with the Clearing Corporation. Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price.

Support

Check out our wiki to learn more. With Ally Mobile, you can view your investments and enter stock trades with just a few taps. It’s likely that many exchanges will be adding verification procedures in the near future. The platform is headquartered in Seychelles, with a growing number of users in Asia, Europe, the Middle East and Africa. No one likes losing money but sometimes, placing a stop loss too close to your entry point is self defeating as you are not giving the market enough time to prove you right. Terms and conditions for the €100 transaction fees offer. With the right education, practice, and risk management, beginners can develop the skills necessary to navigate the financial markets successfully. Any pointers appreciated. It all starts with finding the right stockbroker for yourself. Learn about the different trading and investment products available on the market and discover how to choose the right one for you. For more information, please see our Cookie Notice and our Privacy Policy. Measure advertising performance. Daily charts are used for analyzing periods longer than six weeks, according to the thumb rule. How We Use Cookies and Web Beacons. However, with the introduction of electronic trading, the open outcry system was replaced by trading accounts, which traders can use to buy and sell securities electronically without being physically present on the trading floor.

Value Add

If you went long on your trade and the company’s share price goes up by 40 cents, your 1000 shares are now worth 140 cents each. Rather than attempt to solve the differential equations of motion that describe the option’s value in relation to the underlying security’s price, a Monte Carlo model uses simulation to generate random price paths of the underlying asset, each of which results in a payoff for the option. Call Backspreads are used for trading up moves; put backspreads for down moves. Why Are Mutual Funds Subject To Market Risks. His career focus is managing and creating content for websites in the finance and DeFi space. If I look at the CHF/USD trend considering for example the use of IB rather than DEGIRO, I could make a similar conclusion. Complete your all in one KYC process. “DEGIRO was voted Best Broker 2023 by votes from the public. Are there any trading apps specifically designed for beginners. This pattern can reverse the downtrend, potentially leading to an uptrend. This happened despite the strong focus of the crisis in the US. Will only make you a better trader. Scalping is considered high risk due to the rapid pace of trading and the need for precision. We take complete care of the security and privacy of any person who comes to download any color trading app from our website.

Promotions

Therefore, it’s suggested you note the pros and cons of different growth strategies and zero out on what works best for you and your goals. Cost effectiveness remains a significant factor, with traders scrutinizing not only commission fees but also other associated costs, such as account maintenance fees and foreign exchange fees for international trading. Book: Liar’s PokerAuthor: Michael Lewis. A long call spread gives you the right to buy stock at strike price A and obligates you to sell the stock at strike price B if assigned. Learn about essential valuation techniques, financial statements, and the fundamentals of stock investing, as well as the factors that influence stock prices and how to analyze them. This strategy is useful for traders who seek to benefit from short term price trends and capitalise on market movements. It is expressed in MAR as being information that a reasonable investor would be likely to use as part of the basis of their investment decisions. When you’re opening an account, you’ll want to have at hand your financial information, including your bank details. For most individuals, long term, diversified investment strategies remain a more reliable path to financial growth. Due to regulatory obligations, bonuses are not applicable to Plus500CY Retail customers. The opposite is true when you open a short position. Reviewing the live trading results from the first strategies. It’s particularly useful for both scalp traders and day traders when trailing stops or determining reversal points in a trending market.